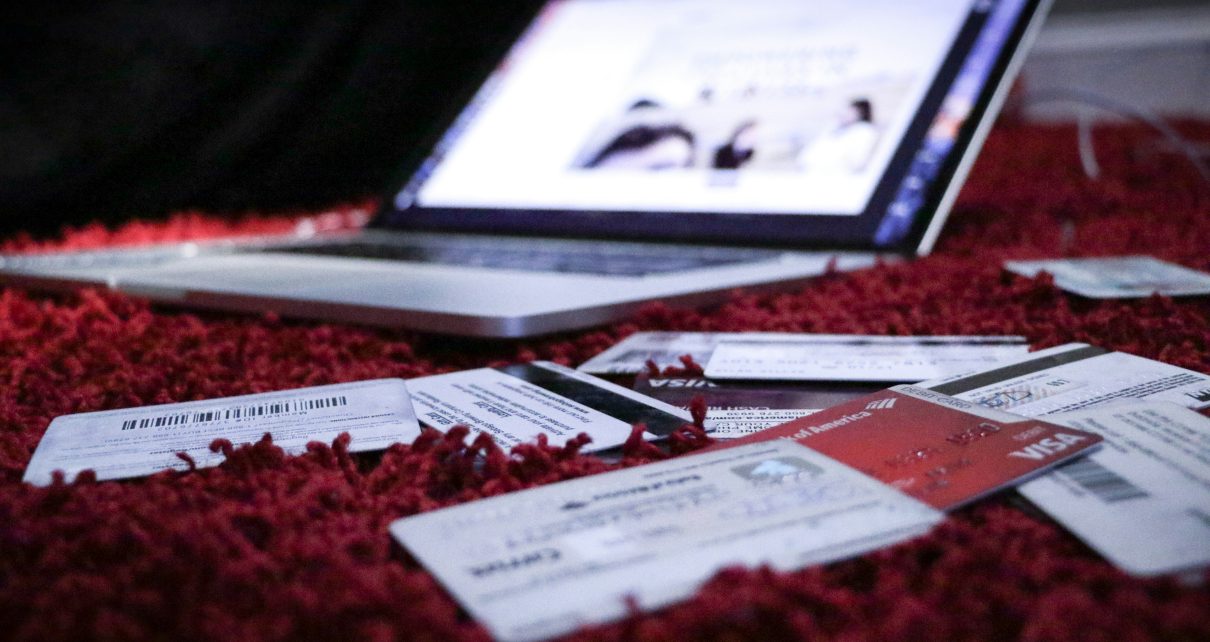

Your credit score can feel like a mysterious number that holds the keys to financial freedom. It influences whether you can secure a loan, rent an apartment, or even land your dream job. If you’re staring at a low score and wondering how to turn things around quickly, you’re in the right place.

Bad credit doesn’t have to be a life sentence. With some strategic moves and dedication, you can start improving your score in no time. Whether it’s correcting errors on your report or understanding the impact of outstanding debts, small steps can lead to big changes.

Let’s dive into the world of credit scores and explore effective strategies for fixing that less-than-ideal score fast!

Understanding Credit Scores

Credit scores are numerical representations of your creditworthiness. Ranging from 300 to 850, these scores help lenders assess the risk of lending you money. The higher your score, the more favorable terms you’re likely to receive.

Several factors contribute to this score. Payment history plays a crucial role; consistent on-time payments can significantly boost your rating. Meanwhile, credit utilization—how much credit you’re using compared to what’s available—also impacts your score.

Length of credit history matters too. Older accounts can indicate stability and responsible management. Applying for new credit frequently might raise red flags for potential lenders.

Understanding these components is essential for taking control of your financial future and making informed decisions about improving your situation.

The Impact of a Bad Credit Score

A bad credit score can have far-reaching consequences. It often leads to higher interest rates on loans and credit cards, making borrowing more expensive over time.

Many lenders see a low score as a sign of risk. This perception can limit your access to favorable loan terms or even prevent you from securing financing altogether.

Beyond financial products, housing options may dwindle as well. Landlords frequently check credit scores before renting out properties, and a poor score might lead to rental rejections.

Employment opportunities can also be affected. Some employers review credit histories during the hiring process, especially in finance-related roles, making it tougher for those with bad scores to land jobs.

Every aspect of life that involves money could be impacted by your credit standing. Understanding this reality is the first step toward taking control of your financial future.

Steps to Fix Your Credit Score

Fixing your credit score requires proactive steps. Start by reviewing your credit report. This document holds vital information about your financial history, including payment records and outstanding debts.

Next, identify any inaccuracies or errors. If you find discrepancies, don’t hesitate to dispute them with the credit bureau. Correcting these mistakes can lead to an immediate boost in your score.

Paying off existing debts is another crucial step. Focus on high-interest accounts first, as they can drain your finances quickly. Reducing debt will not only improve your score but also relieve stress.

Consider using secured credit cards wisely. These cards require a cash deposit that serves as collateral, helping you build positive credit history when used responsibly.

Each of these actions brings you closer to achieving a healthier financial profile and improving that all-important number.

A. Review Your Credit Report

The first step to fixing a bad credit score is reviewing your credit report. This document holds the key to understanding what affects your score.

Start by obtaining a free copy from major credit bureaus like Equifax, Experian, and TransUnion. You’re entitled to one free report annually from each bureau, so take advantage of this opportunity.

As you review the report, pay attention to every detail. Look for accounts that don’t belong to you or debts that are inaccurately reported. These discrepancies can hurt your score significantly.

Make note of any late payments or high balances as well. Understanding where you stand is crucial in creating an effective plan for improvement.

Taking time to dissect your credit report sets the foundation for all subsequent steps toward better financial health. It’s about knowing exactly what you’re up against before tackling those issues head-on.

B. Dispute Any Errors or Inaccuracies

Errors on your credit report can significantly impact your score. It’s crucial to address any inaccuracies promptly.

Start by obtaining a copy of your credit report from all three major bureaus: Experian, TransUnion, and Equifax. Look for mistakes such as incorrect account information or late payments that don’t belong to you.

Once you’ve identified errors, gather supporting documents to back up your claims. This evidence could be payment receipts or correspondence with creditors.

Next, file a dispute with the bureau reporting the error. You can often do this online for convenience. Include details about the inaccuracy and attach any documentation that supports your case.

Keep records of everything you send and receive during this process. The bureaus are required to investigate disputes within 30 days, so stay proactive in following up if necessary. Correcting these mistakes can lead to significant improvements in your credit score over time.

C. Pay Off Outstanding Debts

Paying off outstanding debts is a vital step in improving your credit score. It shows lenders you are responsible and can manage your finances effectively.

Start by listing all your debts. Focus on high-interest accounts first, as they cost you the most over time. Consider strategies like the snowball or avalanche method to tackle them systematically.

Set achievable goals for repayment. Small victories can keep you motivated. Once you’ve paid off a debt, celebrate that milestone instead of rushing into more spending.

If you’re struggling with payments, explore options like negotiating lower interest rates or setting up a payment plan with creditors. Many companies prefer working with you than risking non-payment.

Consistency matters; make timely payments every month to build trustworthiness in the eyes of lenders. Each payment not only reduces what you owe but also adds positive history to your credit profile.

D. Use Secured Credit Cards Responsibly

Secured credit cards can be a powerful tool for rebuilding your credit. They require a cash deposit, which usually serves as your credit limit. This minimizes the risk for lenders while allowing you to demonstrate responsible usage.

Using these cards wisely is essential. Make small purchases that you can easily pay off each month. This keeps your credit utilization low and showcases reliability to creditors.

Always make payments on time. Late payments can derail the progress you’re making toward a better score. Set reminders or automate payments if necessary.

Avoid maxing out the card, even if it’s tempting during emergencies. Maintaining only 30% of your available limit will have a positive impact on your score over time.

Regularly review your statements for any discrepancies and keep an eye on how using the card affects your overall financial health.

Tips for Maintaining a Good Credit Score

Maintaining a good credit score is about consistency and smart habits. First, always pay your bills on time. Late payments can drastically hurt your score.

Next, keep your credit utilization below 30%. This means you should use only a small portion of your available credit to show lenders that you manage debt responsibly.

Consider diversifying your credit mix. Having different types of accounts like revolving credit cards and installment loans can positively impact your score.

Regularly monitor your credit report for issues or changes. Being proactive helps catch errors before they affect you negatively.

Limit the number of new accounts you open within a short period. Too many inquiries can signal risk to potential lenders and lower your score temporarily.

By staying vigilant and informed, you’re setting yourself up for long-term financial health.

Resources for Rebuilding Your Credit

Rebuilding your credit can feel overwhelming, but several resources are available to assist you on this journey. Start with nonprofit credit counseling services that offer free or low-cost advice tailored to your needs.

Online platforms also provide tools for tracking your progress. Websites like Credit Karma and AnnualCreditReport.com allow you to monitor changes in your score and review reports without cost.

Consider financial literacy courses as well. Many community organizations offer workshops covering budgeting, debt management, and credit-building strategies.

Don’t overlook support groups or forums where individuals share their experiences and tips for improving credit scores. Connecting with others can provide motivation and insight into effective approaches.

Explore local banks or credit unions that may have special programs designed for those looking to rebuild their financial health. They often feature lower interest rates on secured loans or cards specifically intended for rebuilding purposes.

Common Mistakes to Avoid

One common mistake is ignoring your credit report. Many people forget to check for errors or outdated information that could hurt their score. Regularly reviewing your report can help you stay informed.

Another pitfall is applying for too many credit accounts at once. Each application leads to a hard inquiry, which can temporarily lower your score. Space out your applications and be strategic about them.

Additionally, missing payments can be detrimental. Late payments affect your credit history significantly and remain on record for years. Set up reminders or automatic payments to avoid this issue.

Some may think closing old accounts will improve their score. In reality, keeping older accounts open boosts the length of your credit history—a key factor in scoring models. Maintain those seasoned accounts while managing new ones wisely.

Conclusion

Improving a bad credit score is not an overnight task, but with dedication and the right strategies, you can see significant progress in a short amount of time. By understanding how credit scores work and taking proactive steps to rectify your financial situation, you’re setting yourself up for success.

Remember that consistent efforts yield results. Regularly monitor your credit report, address any inaccuracies promptly, and stay on top of your debts. Using secured credit cards wisely can also help build positive payment history over time.

Maintaining good habits will go a long way in preserving your improved score. Avoid common pitfalls like missing payments or accumulating unnecessary debt. With these practices in place, you’ll find it easier to secure loans or favorable interest rates when needed.

Rebuilding your credit takes patience and diligence, but it’s definitely achievable. Stay informed about resources available to assist you along the way; knowledge is power when it comes to managing finances effectively.

A better credit score opens doors—whether that’s securing loans at lower interest rates or qualifying for premium financial products. Embrace this journey towards financial health with optimism and determination; brighter days are ahead!